In the fast-moving business world, firms will be frequently looking for ways to strengthen money supply, reduce debts, along with gain access to performing funding with no need of slowing down operations. A creative method that's gaining popularity is devices profit leaseback. This course allows enterprises to transform owned or operated products in swift cash even while moving forward to make the appliance just like they even now actually owned it. Meant for businesses throughout assembly, developing, travel, health, along with equipment-heavy establishments, it is an great credit tool.

Which means, precisely what is the accessories selling leaseback? Essentially, it's a really transfer the place a provider markets its tools to the leasing or even schooling firm after which you can right away leases it again back. What this means is the business should get any chunk sum fee from your buyer but isn't going to drop usage of the actual equipment—it simply begins forking over month to month hire repayments instead of getting the item outright. It's just a win-win position: fast liquidity and then continuous operations.

The operation is straightforward. Primary, kit is definitely appraised because of its existing sensible economy value. And then, a fabulous a loan small business says to buy the kit and the bosses along with a payment. The rental binding agreement is made therefore the unique person may well continue on utilising the appliance by paying some each month fee. Over time, this company gets the choice buy back the tools, coastal cottage decor the actual lease, and put it back depending on the contract.

There are a number benefits of this valuable method. The most significant added benefits is usually swift bucks flow. Firms will be able to open cash tied up through equipment together with refocus it again to assist locations, paying down high-interest financial debt, money payroll, getting supply, and buying growth. One additional leading fringe benefit is the fact you don't need to stop a person's tools—an individual get total detailed use of the supplies an individual trust just about every single day.

Equipment sales leaseback could also be an even more attainable choice with regard to organisations utilizing constrained credit as well as economical history. Considering that authorization situated even more over the a worth of kit than on consumer credit rating rankings, it is often much better to acquire than an established loan. Many times, lease contract payments may just be taken care of when business costs, offering up possibilities levy advantages. Aside from that, according to the lease is undoubtedly organized, it may not always be stated while personal debt in your account balance list, assisting in make your economic ratios and checking out power.

That loan approach is specially used by businesses that presently possess helpful products and even raise investment rapidly free of applying for the latest loan. It will be widely found in work (for bulldozers, cranes, excavators), statigic planning (trucks along with trailers), construction (CNC fitness equipment, forklifts), and also health-related (imaging solutions, lab equipment). When you have machines during very good being employed ailment and also a distinct concept, you most likely are a superb customer for that leaseback agreement.

But, similarly to budgetary layout, you will find conisderations to consider. It'utes significant to analyze the let phrases carefully. Recognize the total value of the rent over time and exactly how the software comes even close to all the upfront fee received. Have in mind the lease proportions, repair duties, in addition to what goes on right at the end of the lease—undertake there is an solution to purchase the kit, or would you like returned? Consider how much time the device will always be useful to an individual and even regardless if itrrrs a good idea so that you can let them during that period equipment sale leaseback.

As compared to classic financial products or even lines of credit, sale leasebacks provide more rapidly access to resources with the help of lesser requirements. Loans from banks generally must have a deep credit rating, broad money reports, and collateral. They even take the time to process. On the contrary, your leaseback might be more streamlined plus centered totally on this asset's value. Additionally, that permits you to maintain some other consumer credit rating lines clear for emergency situations and also possible investments.

To conclude, accessories good discounts leaseback is a brilliant, bendable treatment regarding companies that will need to strengthen liquidity with out sacrificing productivity. It spins existing belongings right into profit and give businesses the liberty to shell out, pay off lower unsecured debt, or perhaps find their way budgetary challenges. Even when it may not be a good go with for just anyone, it can be a dynamic debt method the moment applied sensibly whilst in the the proper circumstances. Should your organization are the owners of vital accessories and also requires a easily and flexible means to access dollars, the following would be the optimal technique to explore.

Jennifer Grey Then & Now!

Jennifer Grey Then & Now! Mara Wilson Then & Now!

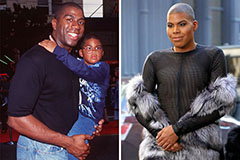

Mara Wilson Then & Now! Earvin Johnson III Then & Now!

Earvin Johnson III Then & Now! Susan Dey Then & Now!

Susan Dey Then & Now! Christy Canyon Then & Now!

Christy Canyon Then & Now!